The Spectacle of Fraud

Real Cheaters Slip Away While the Vulnerable Get Flagged

Since Donald Trump’s reelection in 2024, headlines have been ablaze with talk of “massive fraud.” His newest creation—the Department of Government Efficiency (DOGE), helmed by Elon Musk—claims it can save billions by doing things like rooting out “zombie recipients” in Social Security and erasing fake debts from defense budgets.

In reality, however, many of these ‘egregious’ cases stem from mundane data glitches—missing digits that render real people into statistical phantoms or minor typos that thrust valid beneficiaries into bureaucratic purgatory.

Instead of modernizing these outdated systems like it pretends to do, DOGE leverages such examples to cast everyday citizens as would-be scammers.

Diagram 1: An inverted funnel illustrating how sensational headlines about widespread fraud narrow into minimal proven wrongdoing—while sophisticated cheaters often remain out of sight.

The Fraud Narrative: Simple, Catchy, and Misleading

Moral panics around “fraud” typically rely on outlandish anecdotes. A supposed “150-year-old” beneficiary, for instance, becomes front-page material, spurring calls for a swift “cleanup.” In practice, agencies respond by tightening rules and re-checks.

Meanwhile, truly cunning abusers—those exploiting inside knowledge or large-scale contract loopholes—often dodge these blunt efforts.

Consider popular culture parallels:

Brazil (1985): A small bureaucratic error balloons into chaos.

Don’t Look Up (2021): Politicians fixate on spectacle while ignoring a genuine crisis.

Dirty Money (2018 & 2020): Large-scale corruption thrives behind illusions; small anomalies get hammered.

Operation Varsity Blues (2021): Real cheaters bypass official channels; normal participants drown in complex forms.

Fraud is a Fiction With Teeth

To understand why this pattern persists, we might need to look beyond policy and into anthropology.

David Graeber once noted that debt is as much a moral construct as a financial one. In a similar way, “fraud” is about social control as much as it is about factual deceit. Small-scale deceptions in traditional societies might be worked out through public negotiation or communal shaming. Modern bureaucracies, on the other hand, weaponize the term “fraud,” blocking people from vital resources.

Those with meager documentation or chaotic life circumstances get flagged, while the well-connected continue bending rules with a veneer of legitimacy.

Real Victims of the Overreach

The friction-laden approach rarely catches cunning exploiters but does trip up:

Seniors risk losing benefits over an overlooked re-verification letter or a date entry mismatch.

Families with changing addresses find themselves permanently on the suspicion list.

Migrant workers or those in gig employment—whose personal data rarely fits neat templates—appear “noncompliant” through no deliberate fault.

While true fraudsters exist, they often run sophisticated schemes that routine re-checks or repeated forms fail to detect.

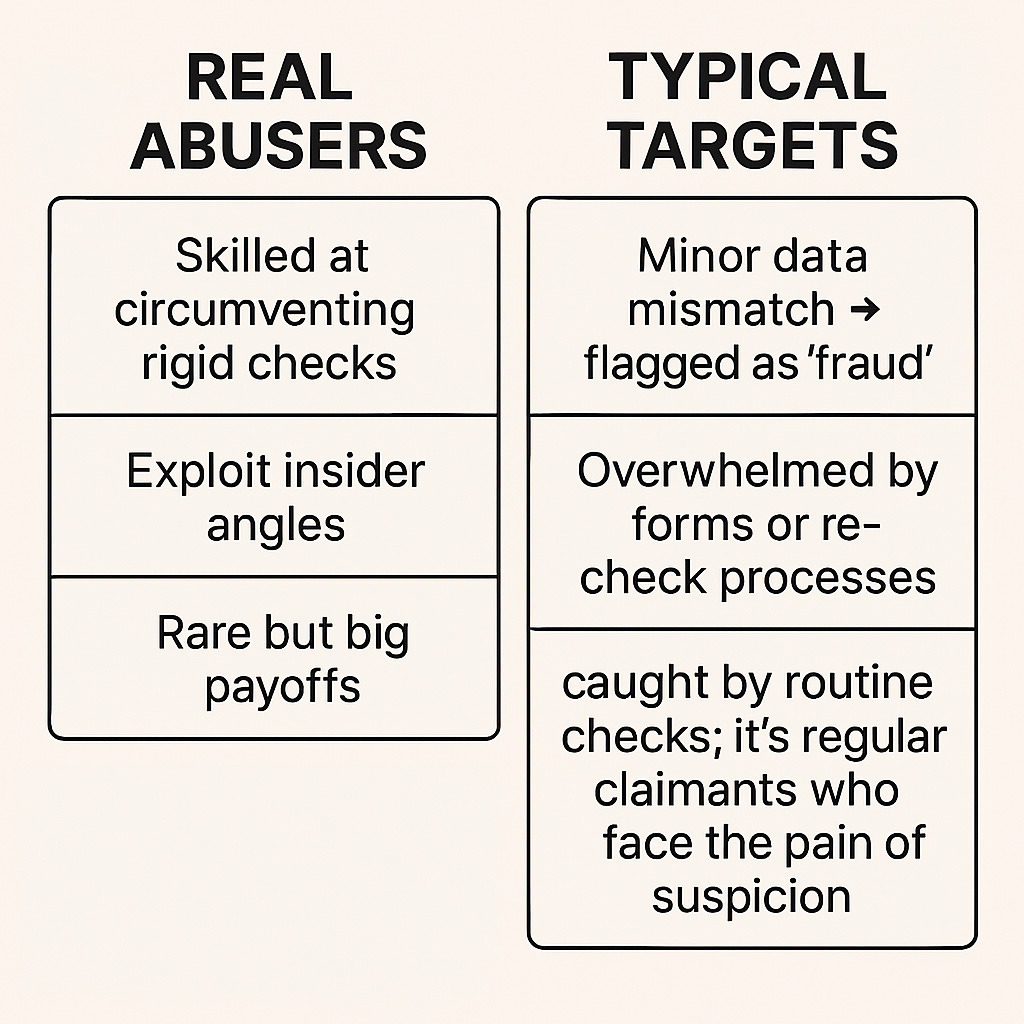

Diagram 2: A side-by-side comparison between clever exploiters, who typically sidestep these checks, and regular claimants, who are ensnared by excessive scrutiny.

A Bureaucracy of Friction

Instead of issuing one outright denial, these systems often wear people down with incremental hurdles. You might miss a re-verification deadline, overlook a newly requested document, or get lost in a maze of confusing forms.

Each mistake widens the distance between you and your benefits, until these small missteps accumulate into a total shutdown—leaving people cut off for reasons that have nothing to do with intentional fraud.

Diagram 3: Each additional layer of paperwork and verification can topple otherwise honest users out of the system entirely.

The Domino Effect

A single data mismatch can trigger an ever-expanding chain of suspicion. One alert flags your record for further scrutiny, spawning new sets of forms, shorter timelines, and bigger penalties. If you slip up again at any point, your benefits freeze. While you can technically appeal, the process can be so convoluted that many people simply give up.

Thus, a small database glitch or a late submission can balloon into a major crisis for those who lack the time, knowledge, or resources to navigate the red tape.

From Spectacle to Reform

Sensational fraud stories often obscure the fact that far more significant abuses (e.g., in corporate or defense budgets) go largely unexamined. By criminalizing every discrepancy, we undermine public trust, penalize honest mistakes, and let more cunning operators continue exploiting bigger loopholes without detection.

A fairer approach would admit life’s messiness:

addresses change

family structures vary

incomes fluctuate

documents get lost

Rather than punishing each deviation, a proportional system would direct energy toward genuine wrongdoing while maintaining a viable safety net for those who truly need help.

Until we recognize this gap, “fraud prevention” will continue to be a cover for slashing budgets, excluding the vulnerable, and enabling genuine abusers to remain safely behind the scenes.

For more on exclusion-by-design and how to create more humane systems, visit syadvada.com.